Navigating the latest crypto run

People are wondering what’s next and where the opportunities lie. Here's where I think it's going.

With a total market cap fast approaching $4T, crypto is back (if it ever left??). People are wondering what’s next and where the opportunities lie. From a non-technical creative x new tech POV, here's where I think it's going.

First off, I know you're not supposed to say this, but this time feels a little different. This isn't 2021.

Sure, Hawk Tuah girl got caught with a pump and dump and disappeared. That certainly gave me nostalgia for some vintage scams.

But that's a flash in the pan compared to the last cycle – when hundreds of celebrities flocked to NFTs, flooding into every aspect of media and pop culture. I don’t have to name names. You remember. Or maybe you forgot?

Kim Kardashian, Matt Damon, Larry David, Tom Brady, Rob Gronkowski, Logan Paul, Reese Witherspoon, Jimmy Fallon, Post Malone, Stephen Curry, Lebron James, Mila Kunis, Snoop Dogg, Madonna, Paris Hilton, Justin Bieber. Idk I’m just going off the top of my head.

This cycle feels different, because, well, outside of our little crypto-tech bubble, everything seems relatively quiet. Fartcoin is starting to drip into mainstream media circles, but there isn't nearly as much noise, despite the industry hitting ATHs across the board, despite electing a crypto-friendly administration in the world's largest economy for the first time ever.

It’s either a potential sign for further growth (not a top signal) or reflective of crypto’s continued struggle to break through the mainstream in the long-term.

Trends to look out for in 2025:

Increased net inflows from institutional investors

Further meme-ification of finance

Rise of onchain AI agents (blockchain x ai) that will eventually spill over into quantum computing

A second chance for music and gaming (and by extension IP)

1. Institutional money in crypto

3 years ago, Kevin O’Leary (the bald shark tank guy) shrewdly pointed out the untapped potential of institutional investment in Bitcoin.

“You want to talk about bitcoin going to $100K, $200K, $300K? It’s going to happen when institutions can finally buy it.”

In other words, when institutions finally get the go-ahead to buy crypto from regulators in the face of ESG mandates, “the price of the coin is going to appreciate dramatically,” O’Leary concluded.

When O’Leary made that statement in 2021, there was no Bitcoin ETF, no Ethereum ETF, no light at the end of the tunnel to stop anti-crypto activists like SEC Chair Gensler or Senator Warren from pushing harsh regulation.

Today, the largest economy in the world has a crypto-friendly administration entering office. That’s unprecedented. In tandem, banks and corporations are slowly changing their tune and treating digital assets like an opportunity rather than a threat.

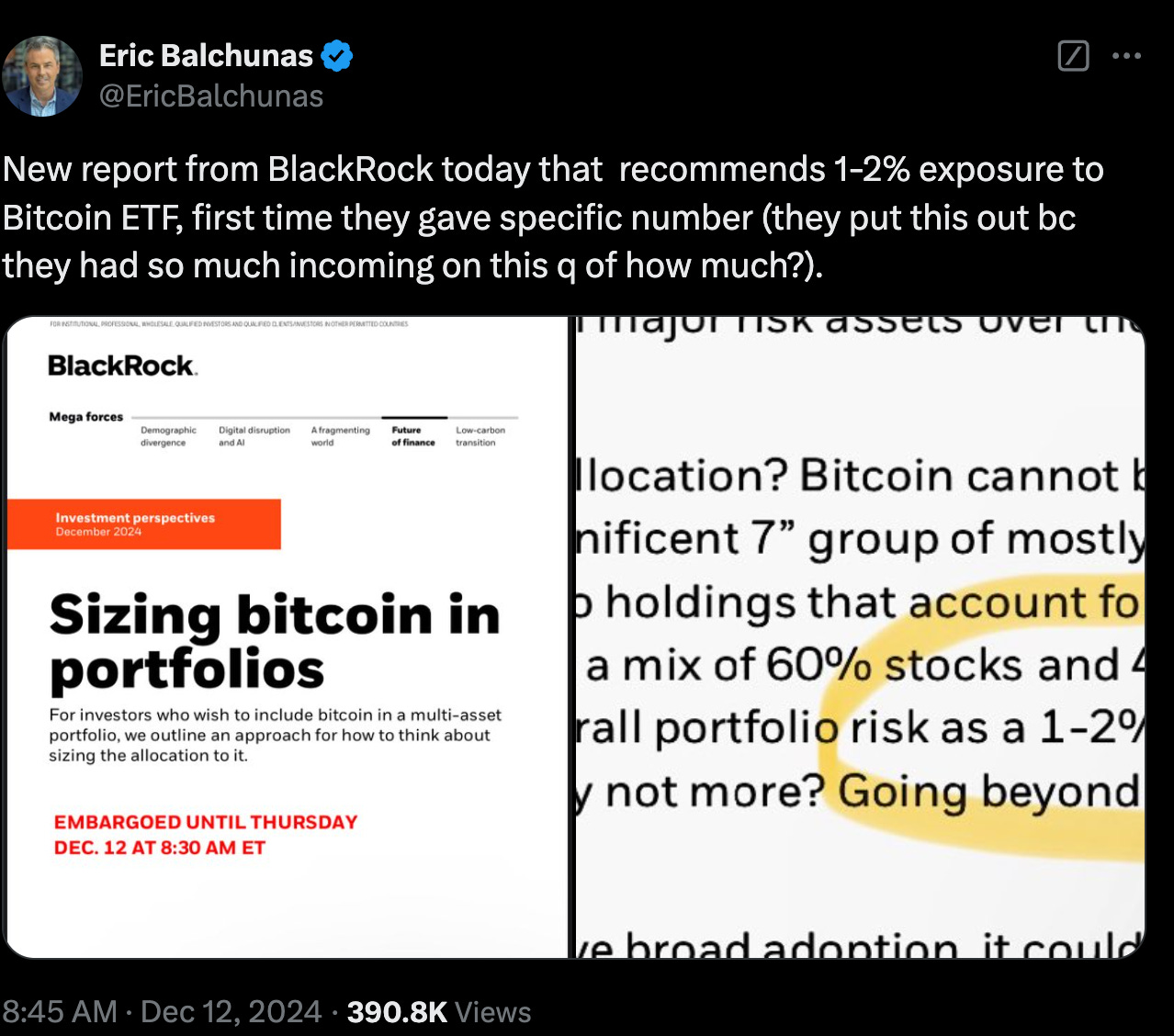

Blackrock, the world's largest asset manager, came out last week and recommended 1-2% exposure to Bitcoin ETF. Morgan Stanley and Goldman Sachs, once notorious for hating crypto, have opened their doors to alternative digital assets.

TLDR: this is the first big opportunity for crypto to legitimize itself on an institutional level at scale. And the potential growth from that cannot be understated.

2. Memes x finance

Memes are the currency of Internet culture. They are visual manifestations of trends and conversations, contemporary news and politics, music and art. They represent the future of media and entertainment.

Finance, on the other hand, is living in the 20th century. With grey desks and powerpoint presentations, it’s a world in desperate need of a makeover.

Mix in instant communication, mass consumer media, hyperinflation, and exploding national debt, and you get a global socio-economic movement of everyday people fed up with legacy financial systems, looking for an alternative. Enter memecoins.

Memecoins break the Internet. It's a f*ck you to traditional finance and media. This is only the beginning, not the end.

Litquidity / Exec Sum is the new Bloomberg. Fartcoin is the new penny stocks. Like it or not, cultural moments can now be instantly memorialized and monetized. Catch up or get left behind.

3. Rise of AI agents (onchain), then quantum

Not an expert on this by any means. Would recommend reading this article from Coinbase CEO Brian Armstrong instead. But I’ll leave you with this snippet:

“AI agents cannot get bank accounts, but they can get crypto wallets. They can now use USDC on Base to transact with humans, merchants, or other AIs. Those transactions are instant, global, and free.”

Once the convergence of blockchain x ai is complete, quantum will come roaring.

4. A second chance for music and gaming (and by extension IP)

Music and gaming have long been an ideal use case for crypto. Many have tried, few have made progress, no one’s really figured it out.

Story Protocol has a good foundation for onchain IP in general, but it’s too early to tell if it’ll work. Audius has a good concept for a decentralized DSP (ie Spotify), but from a distance feels like it fell flat.

People want access to all music, not just new music uploaded onchain. Gaming is seeing some traction with TG mini apps, but AAA studios still don’t see the value of onchain collectibles or the like.

With more institutional trust and a fresh perception that skews more positive and less opportunistic, I think there’s a major opportunity for crypto to tap into music and gaming in this latest cycle.

Obviously music is broken. Just need something global, equitable, creator-centric, innovative to fix it. * cough cough *

Anything big I’m missing for 2025? Would love to hear your thoughts.

- Jared